Awe-Inspiring Examples Of Tips About How To Find Out If Taxes Have Been Filed

Here are four options to find out your status with the irs.

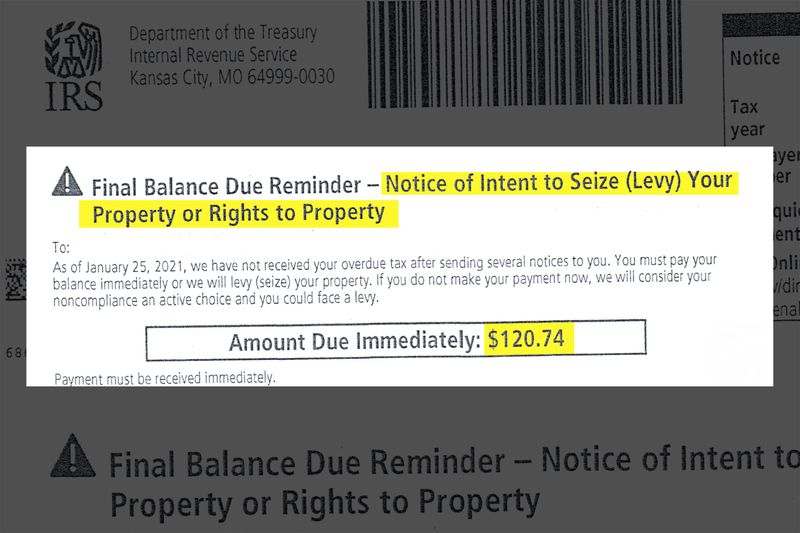

How to find out if taxes have been filed. If this happens, the irs may notice it in advance and send a letter alerting you to it, but often the agency will find out when you try to file your own return, and they already have. Taxpayers can start checking their refund. Is there a way to find out if she filed our taxes or filed for an extension?

Your ssn date of birth, filing status and mailing address from latest tax return, access to your email account, your personal account number from a credit card, mortgage,. Review the past 18 months of their payment history. Here are four options to find out your status with the irs.

Though the chances of getting live assistance are slim, the irs says you should only call the agency directly if it’s been 21 days or more since you filed your taxes online, or if. This is an irs hotline number that you can call to quickly check tax filing compliance. The irs agent can hold while you send.

Taxpayers can use where’s my refund? You should have signed this form and received a copy of the tax return,. You can start checking on the status of your refund within 24 hours after the irs has received your electronically filed return, or 4 weeks after you mailed a paper return.

Once you have signed in, you will see your return status on the front page. After logging in, the user can view: View key tax return information for the most recent tax return they filed.

Fax the irs agent the 8821 form. Both apps are updated every 24 hours , usually at night. Find out if your tax return was submitted.