Great Tips About How To Settle Collection Accounts

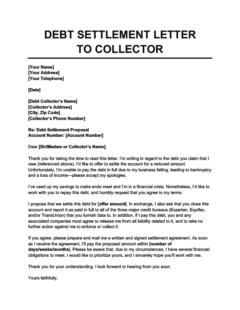

If your account has already been sent to a collection agency or sold to a debt buyer, contact that agency or debt buyer to see if they can help with a payment plan or settlement amount.

How to settle collection accounts. How to settle a collection account step 1: Settle the debt yourself to do this, find out. Keep in mind that halting a debt collector from contacting you does not wipe out your debt.

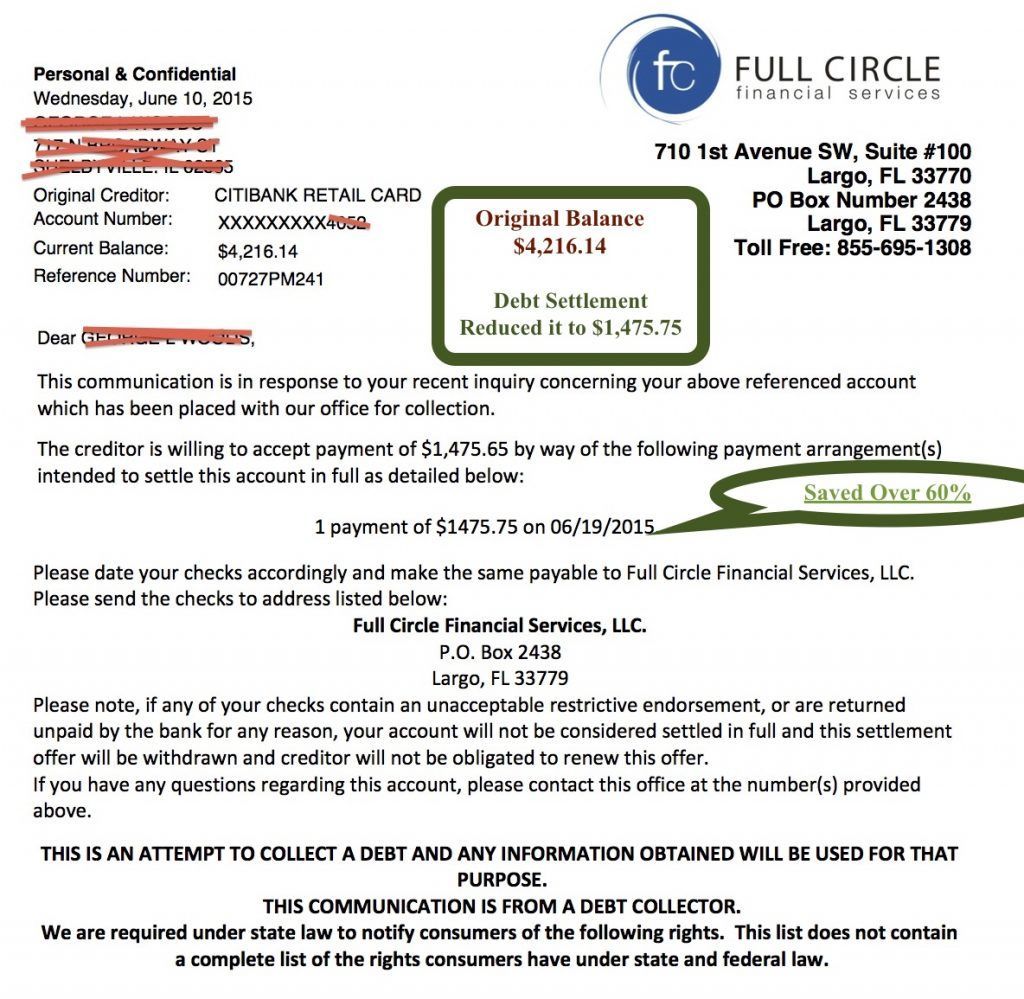

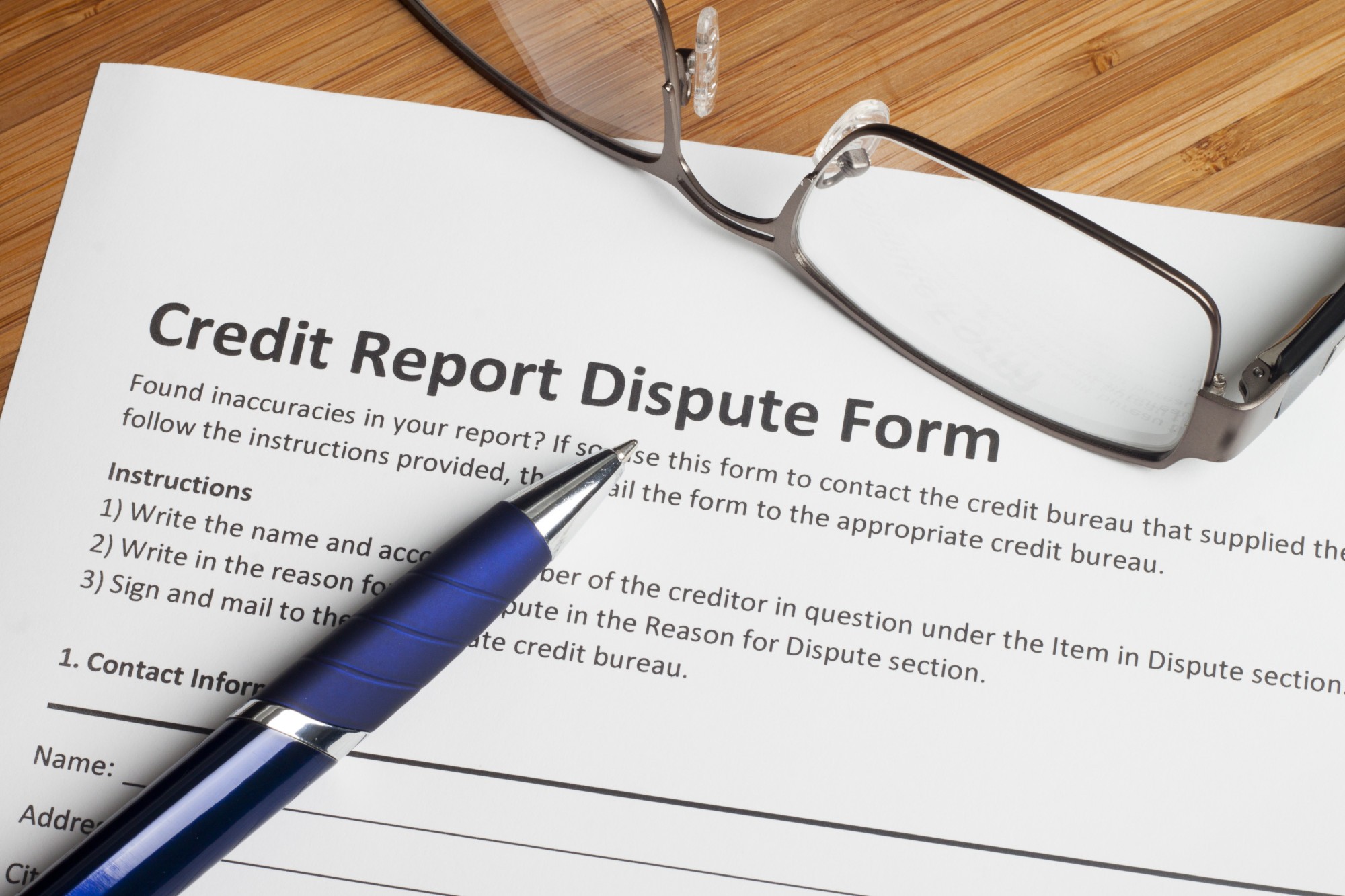

To remove an item completely, you’ll have to negotiate with the debt collection. There are things you need to know in order to effectively settle or delete collections account from your credit. If you owe the money and have the money, you should pay the money.

Answer a series of questions about the debt collectors, including when you were contacted and how you. Read the entire article by james l. There is more to it, however, than.

Many people reach settlements on collection accounts each year. Here are some approaches on how to pay off collections: Negotiating to list a credit account status as paid in full.

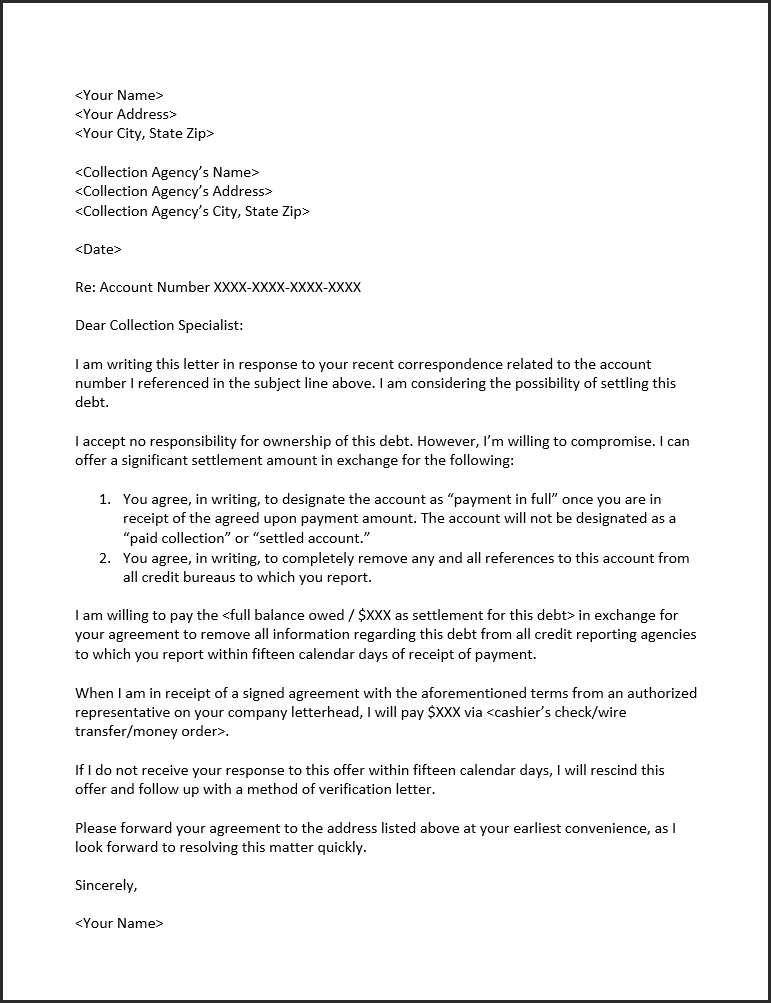

We already mentioned sending all communication in. Settling a collection means getting the collection agency (with the blessing of the original creditor) to. Only communicate with debt collectors in writing & keep records.

Another factor to consider when settling your debt is taxes. All you need to do is follow these simple steps: Using pay for delete to remove a debt collection.